Effective equipment disposition practices can help businesses optimize their equipment portfolio, recover value from disposed of equipment, and make way for new equipment acquisitions. By strategically managing the disposition process, companies can minimize financial losses, maximize asset recovery, and ensure compliance with legal and contractual obligations.

Equipment Maintenance and Upgrades | Finance Facts

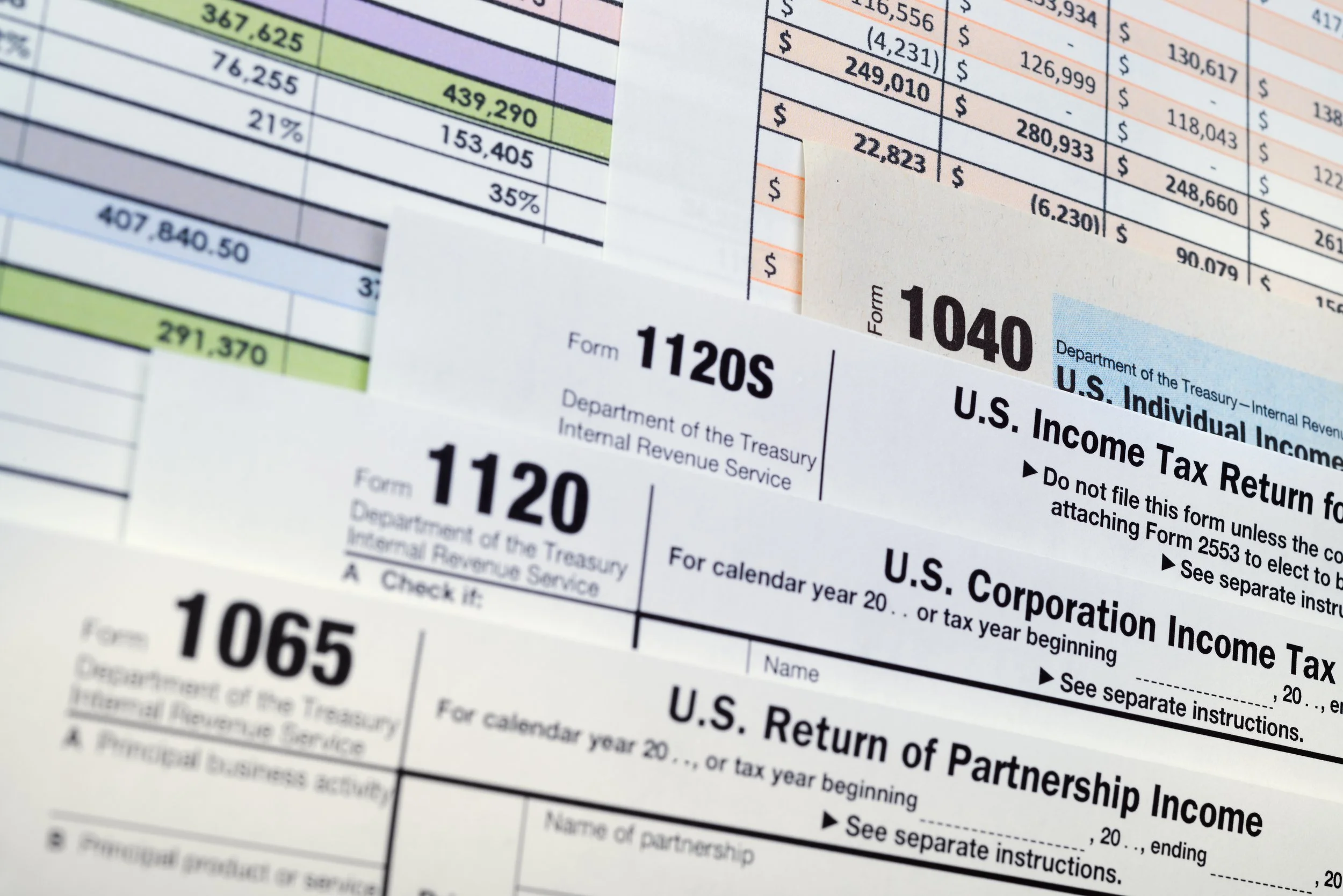

Understanding Tax Considerations | Finance Facts

Understanding Equipment Insurance | Finance Facts

Understanding Commercial Equipment Valuation | Finance Facts

For commercial equipment financing, equipment valuation is vital in determining loan collateral assessment, risk management, and overall financial decision-making. By understanding equipment valuation principles and leveraging professional expertise, businesses can make informed financing decisions and ensure fair and accurate equipment valuation.

Five Steps to Commercial Equipment Selection | Finance Facts

Businesses can select the most suitable equipment that aligns with their operations and financing requirements by carefully assessing equipment, researching available options, considering financial factors, and conducting due diligence. This process ensures that the equipment financed will contribute positively to the company's growth and success.

Credit Analysis | Finance Facts

Based on the credit analysis, lenders or lessors can make educated decisions regarding the approval, terms, and conditions of equipment financing, including loan amounts, interest rates, down payments, lease terms, and any additional collateral requirements. The research aims to balance providing financing opportunities to borrowers while minimizing the lender's risk exposure.