Equipment financing for the manufacturing industry requires careful consideration to ensure that the financing solution aligns with the specific needs and goals of the business. Manufacturing operations can vary broadly in size and scope, i.e. i.e. cannabis to electronics to solar and more!

Here are some key considerations for manufacturers when seeking equipment financing:

1. Equipment Needs Assessment:

Evaluate your manufacturing processes and identify the equipment or machinery required to optimize production, improve efficiency, or expand capacity.

2. Budget and Financial Health:

Assess your company's financial situation to determine how much you can borrow or lease for equipment without compromising other essential financial obligations.

3. Type of Equipment Financing:

Decide between equipment loans and equipment leases based on your preferences and financial circumstances. Loans offer ownership at the end, while leases provide flexibility but may or may not confer ownership.

4. Total Cost of Ownership (TCO):

Consider the TCO, which includes not only the financing costs (interest rates, fees) but also maintenance, insurance, and potential resale value of the equipment. Understanding the total cost will help you choose the most cost-effective option.

5. Equipment Lifespan and Depreciation:

Align the financing term with the expected lifespan of the equipment. Some equipment may depreciate rapidly, so shorter-term financing might be more suitable.

6. Interest Rates and Terms:

Shop around for competitive interest rates and favourable financing terms. Negotiate with lenders or lessors to secure the best possible terms.

7. Creditworthiness:

Prepare your financial statements and demonstrate your company's creditworthiness to lenders. A strong credit history can help secure better financing terms. Higher-end deals require audited financials.

8. Down Payment and Collateral:

Determine whether you can provide a down payment or collateral, as this can affect the terms of your equipment financing.

9. Resale Value:

Research the equipment's resale value, which can impact lease options and potentially lower overall financing costs.

10. Tax Implications:

Consult with a tax advisor to understand the tax benefits associated with different equipment financing options, such as depreciation deductions and potential tax credits.

11. Business Growth Plans:

Consider how acquiring new equipment will support your business growth goals. Ensure that the financing option chosen can accommodate potential expansion or changes in production requirements.

12. Warranty and Maintenance:

Understand the equipment warranty and maintenance requirements, as these costs should be factored into your budget.

13. Default Risk:

Be aware of the consequences of defaulting on equipment financing. Understand the lender's or lessor's rights and the potential impact on your business.

14. Lender or Lessor Reputation:

Choose reputable lenders or lessors with experience in financing equipment for the manufacturing industry.

15. Industry-Specific Considerations:

Specific manufacturing sectors may have unique equipment financing needs. For example, automotive, pharmaceutical and food processing manufacturing may require specialized equipment with specific regulatory compliance considerations.

16. Government Support Programs:

Investigate whether there are government programs, grants, or incentives that can help offset equipment financing costs in your industry or region.

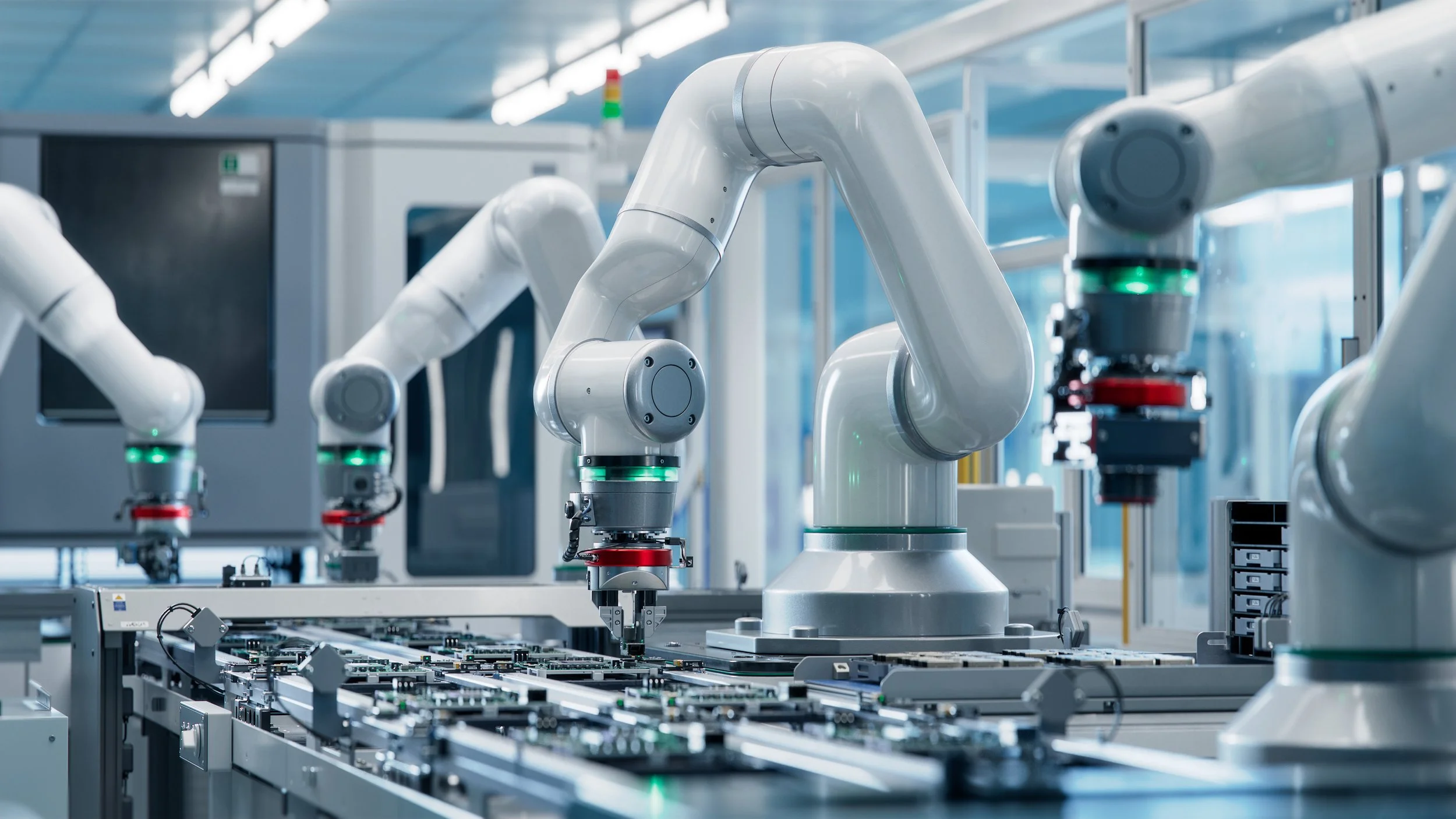

Electronics Manufacturing Plant

Manufacturing expansion funding refers to the financial resources required to grow or scale up a manufacturing operation. Expanding a manufacturing business often involves acquiring new equipment, increasing production capacity, entering new markets, and improving infrastructure. Securing the necessary funding is essential for the success of the expansion project.

Here are several funding options and considerations for manufacturing expansion:

1. Debt Financing:

Bank Loans: Traditional bank loans offer a straightforward way to secure capital for expansion. Manufacturers can use term loans to finance equipment purchases or working capital loans to support increased production.

Equipment Financing: If the expansion involves acquiring new machinery or technology, equipment financing allows manufacturers to borrow money for equipment purchases. The equipment itself often serves as collateral.

Lines of Credit: A business line of credit provides a revolving credit facility that can be used to cover various expenses during the expansion process. It offers flexibility, and interest is only charged on the amount borrowed.

Asset-Based Lending: Manufacturers can use their assets, such as accounts receivable and inventory, as collateral to secure a loan. Asset-based lending can provide significant funding for expansion.

Small Business Administration (SBA) Loans: The SBA offers several loan programs that can be used for manufacturing expansion, including the 7(a) Loan Program and the CDC/504 Loan Program. These loans often come with favourable terms and lower down payment requirements.

Export Financing: Manufacturers exporting their products may benefit from export financing programs, such as export credit insurance or export working capital loans, to support international expansion.

Industry-Specific Programs: Some industries have specialized programs or organizations offering manufacturers funding, research support, or networking opportunities. These can be valuable resources for expansion financing.

2. Equity Financing:

Angel Investors: Angel investors are individuals or groups who provide capital in exchange for equity in the manufacturing company. They may offer valuable industry expertise and connections.

Venture Capital: While less common in manufacturing, venture capital firms may invest in manufacturing companies with high growth potential, especially those involved in innovative or high-tech sectors.

Private Equity: Private equity firms may invest in established manufacturing businesses seeking to expand. They often acquire a significant ownership stake and work to increase the company's value.

3. Crowdfunding:

Crowdfunding platforms allow manufacturers to raise capital by soliciting small investments from many individuals or backers. This approach is particularly suitable for projects with a unique or innovative aspect.

4. Supplier and Vendor Financing:

Negotiate extended payment terms with suppliers or vendors to free up working capital that can be used for expansion. Some suppliers may also offer financing options.

5. Strategic Partnerships:

Partner with larger companies or industry players interested in your manufacturing expansion. Beyond that, entering into strategic alliances or licensing agreements with other companies can provide access to the best technology, distribution channels, and funding for expansion into new markets.

6. Retained Earnings:

Use profits generated by the manufacturing business to fund the expansion. This approach is often a source of internal financing.

7. Business Incubators and Accelerators:

In some cases, joining a business incubator or accelerator program can provide access to funding, mentorship, and resources for manufacturing startups or expansion projects.

8. Strategic Planning and Due Diligence:

Before seeking funding, develop a comprehensive business plan outlining your expansion goals, strategies, and financial projections before seeking funding. Conduct thorough due diligence to assess the feasibility of your expansion project.

Manufacturing expansion funding options vary depending on factors like the nature of the expansion, the company's financial position, and the industry in which it operates. It's essential to carefully consider each funding source, the associated terms and costs, and choose the option that best aligns with your expansion goals and financial capabilities.

Often, a combination of funding sources may be the most suitable approach to support a successful manufacturing expansion. Most of the debt financing options fall under ComFi's umbrella. Consult with a service financial advisor to effortlessly explore all available avenues to secure capital for your expansion plans.